Currently, roughly 5.3 million borrowers are in default on their federal student loans.

The Trump administration ’s announcement marks an end to a period of leniency that began during the COVID-19 pandemic. No federal student loans have been referred for collection since March 2020, including those in default. Under President Joe Biden, the Education Department tried multiple times to forgive millions of people’s student loans, only to be stopped by courts.

“American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” Education Secretary Linda McMahon said.

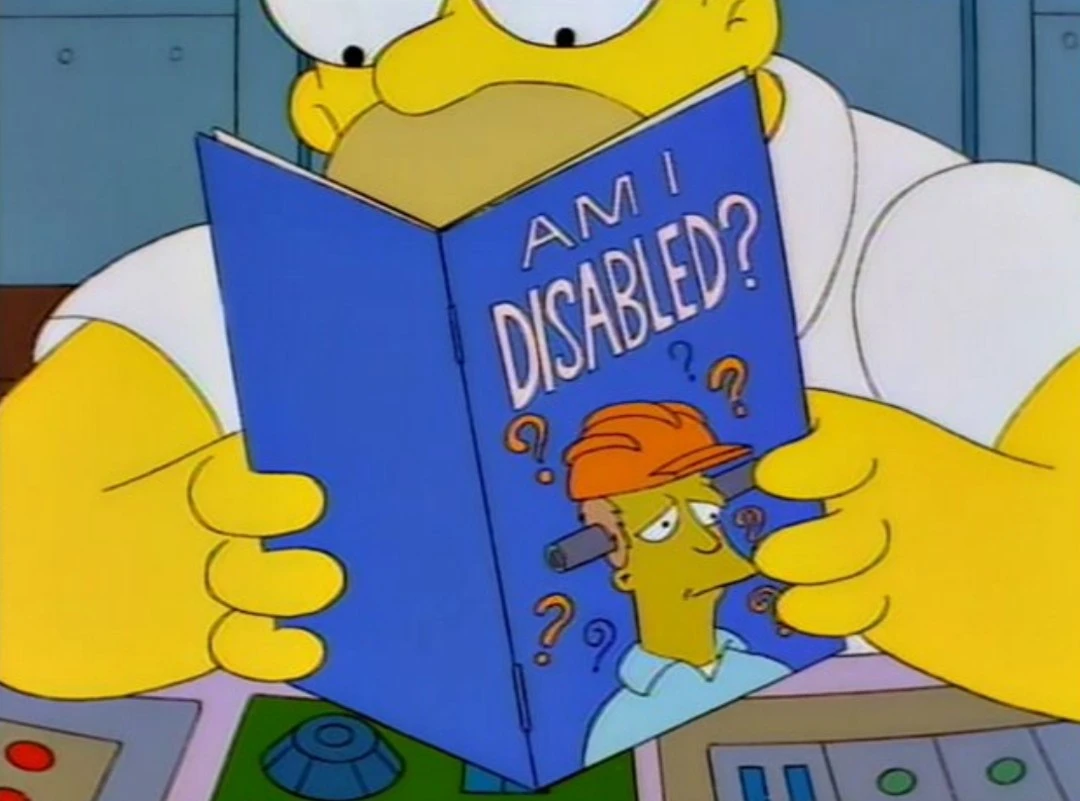

It’s a good thing the entire system hasn’t been a complete dumpster fire for the last few years. I’m sure Mohela got it figured out by now.

They should do that to the auto industry and the banking industry as well, if they are doing it for the student industry.

The American taxpayers should only serve as collateral for massive multinational corporations, obviously. Not the private citizens working to create better lives for themselves and others.

Tough. Honestly every one should tell them to fuck off until trump and crew are gone. No cash to the feds. Not a dime.

The feds are going to be intercepting tax refunds and garnishing wages. Collections isn’t voluntary. This is going to crash the economy

thats why cash is better than digital currency. everyone willingly gave everything to them.

Do you really think your employer would have not sent the cash when they got that certified letter of garnishment just because they were handling cash instead of direct deposit?

This shit is not new

O. K

Under President Joe Biden, the Education Department tried multiple times to forgive millions of people’s student loans, only to be stopped by courts.

Both sides, something something.

“American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” Education Secretary Linda McMahon said.

You’re hurting a large number of those taxpayers by doing this. This is akin to looking for budget cuts by going after who has the smallest amount of funding like NASA and the Arts.

Plus, some countries actually consider investing in their students to improve their overall society. They don’t try to make profit off of them while minimizing who can get an education. I think our goals in the US are a bit messed up.

You’re hurting a large number of those taxpayers by doing this.

That’s the point. They want to hurt people.

Specifically educated people, in this case, because they tend to skew Left.

Ah yes, we need money so let’s go after the poor. Surely they’ll have money we can take. Urgh /s

Got to pay for IRS cuts somehow.

“American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” Education Secretary Linda McMahon said.

You do realize that the people in default are taxpayers, and this is going to make it worse for them and other taxpayers, right? McMahon is such an idiot.

Not just that, but the government makes money off of student loans.

Government backed student loans should either charge interest or be exempt from bankruptcy, not both!

She asked A-one what to do

My favorite is that we’ll still be collateral for irresponsible banks, politicians, tech bros, and war/genocide. But thank God my taxes won’t be paying for someone’s education. 🙃

5.3 million borrowers

My gosh that’s a lot of people. I didn’t realize it was so many.

5.3M probably on federal loan. But way more on Private-like Sallie Mae.

I expected the number to be much much higher.

We have had a culture of “no degree, no job” for 3 decades now.

I’m not forcing my child go to Uni unless he’s sure he wants to.

5.3 is the number in default, there are a lot more with student debt in general (online resources say around 42 million).

I also think the article mentions there are millions more at risk of being in debt, but that’s a whole other can of worms cause (as is the case with Trump and Republicans) communication about loan repayment is unclear.

Good luck with that. Lol can’t get blood from a stone. Once it goes to collection can it be cleared by bankruptcy? Since collections are now holding the loan?

To successfully have both private and federal student loans discharged in bankruptcy, you must show that repaying the loans causes an “undue hardship” on you and your dependents. That’s a tougher standard than those who file for bankruptcy must show to discharge credit card debt, personal loans or past-due utility bills. In many cases, however, it’s worthwhile to try to show you meet this standard if you have a case for it.

There are alternatives to bankruptcy if your loan payments are unaffordable, and since bankruptcy has serious consequences for your credit and financial life, look into those first. If bankruptcy is the right choice for you, here’s how it can wipe out or reduce student loan debt. Source

Oh look, it’s me.

Savor your knee caps while you can. I’m guessing the current administration behave like the mob

What could possibly make him more popular?

As if anything mattered

Gee, I wonder who stands to profit by sending taxpayer-funded debt collectors after people with no money?

Just take the slush money quietly and leave us alone.

Oh man theyre really going to drive a massive depression now.

How many people are up and current on their loans with zero problems? Let’s check the notes… aaaaand it’s under 40%.

“You want to try to better your life, but the market demands for employment fluctuate? Go fuck yourself. Either be a psychic and be 100% certain your job is guaranteed or keep being poor, we don’t do help here in America. We take, we don’t give.”

-GOP